1 min read

Make LA Insurance Affordable

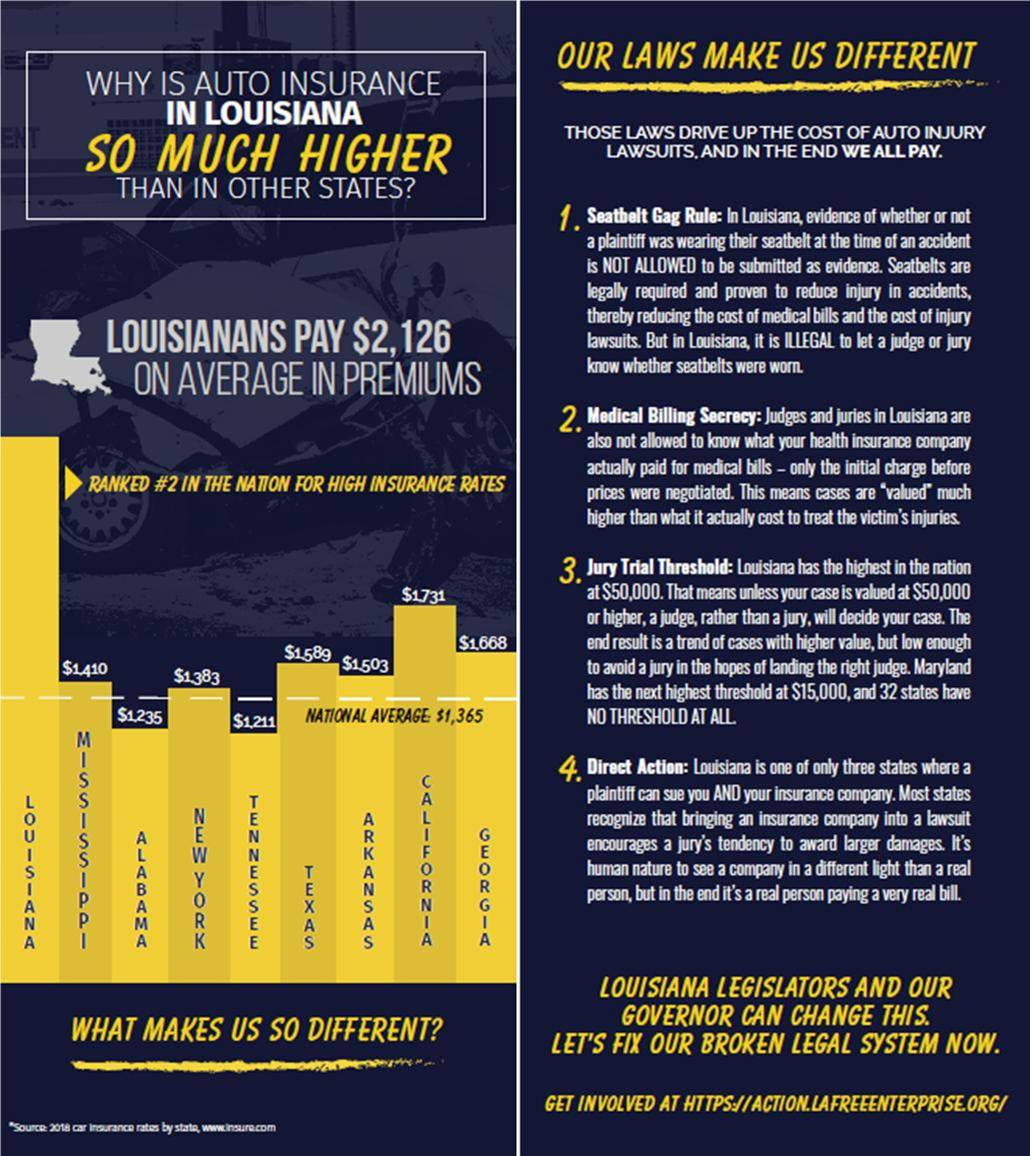

Louisianians are paying the highest price in the country for auto insurance, leaving families with less money for the things that matter most...

2 min read

Levi Kastner

Feb 20, 2020 9:59:26 AM

.png)

.png?width=1024&name=Feature%20Image%20Tem%20(5).png)

We all know insurance rates in Louisiana can be high. This is something that is constantly talked about in our office and brought up from clients. But what can actually be done? It's a super complex issue and I have one really easy solution!

An article came out in "The Advocate" on Feb 11th, discussing the state's largest business lobby and how they want to tilt the state's legal system in favor of business through tort reform.

It also showed how they will try to get this bill signed by Gov. Jon Bel Edwards.

Gov. John Bel Edwards goes on to say the way to actually lower insurance rates is by preventing insurance companies from charging more to people based on their gender, marital status, and whether or not they are a veteran (usually discounts apply to veterans... I know this because I am one, myself) .

I have been an insurance agent for over 10 years now and this topic is a super complex issue. I'm not 100% certain on if Gov. Edwards, is right or if the legislators are right about tort reform however

I can only begin to offer suggestions on how to improve our insurance rates. As this is a very complex problem.

However, taking away insurance companies' ability to offer different rates to different people based on age, sex, location, marital status, credit, etc., which can also be backed up with studies and facts or just plain old actuarial data, in my opinion is not the answer. Though possibly changes could be recommended and implemented, to how data is used.

Why doesn't the state and the legislature do what business owners do?

Can't we go look around at the 50 other states and look at best practices?

It shouldn't be that hard.

We have 48 better examples to pull the best practices from. (Except for Michigan, we aren't listening to them when it comes to insurance.😏 They are in the same boat with us, but even they are trying to make actual changes that will ease insurance costs.)

It's even worse when it comes to commercial auto insurance.

It's so bad in our state right now, businesses are actively moving to neighboring states just to relieve themselves of the super high cost of commercial auto insurance in Louisiana.

That doesn't sound like that's good for business nor the economy, does it?

Let's take a classic approach and go back to the fundamentals if we must.

"Best practices!"

Wow, what a novel, yet common sense approach, right?

Forty-eight other states can do it better than we do it so let's pick whatever state is 30th when it comes to rates!

If we really wanted to try, we could ask each state and pull together what works for us. But that probably just makes too much sense in this partisan world nowadays.

That's just my 2 cents, from a professional insurance agent.

Something has to be done though and that's something I'm sure we can all agree on.

*Mic Drop* 🎤⬇️

Levi Out!

![]() Thimmesch Kastner Insurance is a full service insurance broker based in Lafayette, LA. We offer a variety of insurance products, and will work closely with you to explain all of your options, and coverage’s. We listen to your needs, and develop a customized portfolio for your lifestyle. We offer home, car and auto, liability (Umbrella), health, life, commercial (business), motorcycle, ATV, UTV, RV, and Boat Insurance and Cyber Insurance.

Thimmesch Kastner Insurance is a full service insurance broker based in Lafayette, LA. We offer a variety of insurance products, and will work closely with you to explain all of your options, and coverage’s. We listen to your needs, and develop a customized portfolio for your lifestyle. We offer home, car and auto, liability (Umbrella), health, life, commercial (business), motorcycle, ATV, UTV, RV, and Boat Insurance and Cyber Insurance.

.png)

1 min read

Louisianians are paying the highest price in the country for auto insurance, leaving families with less money for the things that matter most...

.png)

DID YOU KNOW? You could be overpaying for your car insurance, or at least paying for coverage you no longer need. Rates can vary across insurance...

There are many factors that can impact your auto insurance costs such as where you live, what you drive, the insurance company, level of coverage,...